After the first green bar in the weekly chart, this week added another more doji-like candle. And bulls and bears are in balance. So, we couldn’t see bigger movement upwards or downwards.

The next move is near

As you can see, the 200 SMA could not be crossed above but the bears weren’t strong enough yet to break down the -30% price level. Same area as last week.

Last week’s candle is similar to a doji, maybe even an inverted hammer. Therefore a move to the downside would be more likely for the next week. But why the bears couldn’t bring the price at least below 50% of the candle before?

Let’s look at hourly candle of the ES to get a more detailed view:

Here you can see that the bulls could cross the -30% level, tried two times to break above the 200 SMA, failed, but the bears also failed to use this perfect double top as the beginning of the second leg down.

Thursday and Friday created a range. So, both is possible:

The bulls could try a third test of the last two highs. The bears could try their break down the range and the double top pattern.

Of course, both is possible but because of the weekly candles the bears are little bit in advantage.

Just pay attention on 2450 and about 2525 on Monday.

Some words about my positions

Again I had no changes in my accounts last week. I am still holding what I decided to hold some weeks ago and I did not add any new trades.

The correction hit some of my positions very hard but I expect them to react to the upside as fast and strong as to the downside. The third partial of ACM is still running as my only short position. A buy limit for the next 50% is already set, so I am relaxed with my long and medium term positions and I can focus on futures trading.

But one position I will mention here. It’s MKTX. I entered it as a trade more than one year ago (12th of March 2019) and sold two partials with good profits before deciding to hold the third partial (small one). And although it is moving a lot the last months, it’s not as affected from corrections like this as other stocks.

Look at the chart, it broke above the trend line connecting the last highs with a huge green bullish candle:

The red line is my critical level for a long time and it just dipped it a little, so I could hold MKTX.

Another strong position is DEA. I just want to note down such stocks because they are not correlating with the SPY/ES and therefore such stocks are good for a diversified account.

Futures

The margin for futures trading was much lower last week because of the decrease in volatility and I could trade with real money more often. My rule is to start with the paper account and make two times the daily profit goal of my live account before switching to real money. And that’s the best rule I ever created.

So, I traded 3 days live last week:

Last Week:

• Live account: +$39.92 (3 green days)

• Paper account: +$135.26 (4 green days, 1 red)

Last Month (March):

• Live account: -$387.96

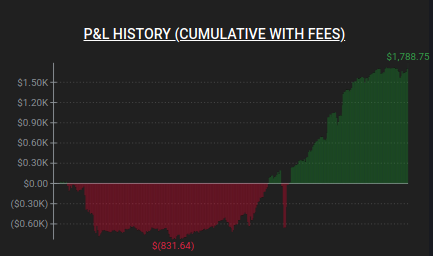

• Paper account: +$1,788.75 (both with a bad first week)

Here the cumulative returns of March for the paper account:

It feels like I am now on my way to consistent profits. Volatility decreased, I worked hard on my mistakes and developed my own style.

I decided to share my bad beginnings that you can see that it’s a difficult and hard way.

Stay healthy!

Now I just wish you a healthy week and not too much difficulties with this exceptional situation!

Let’s see if bulls and bears will be in balance the next week or which side will be stronger. Good trades.