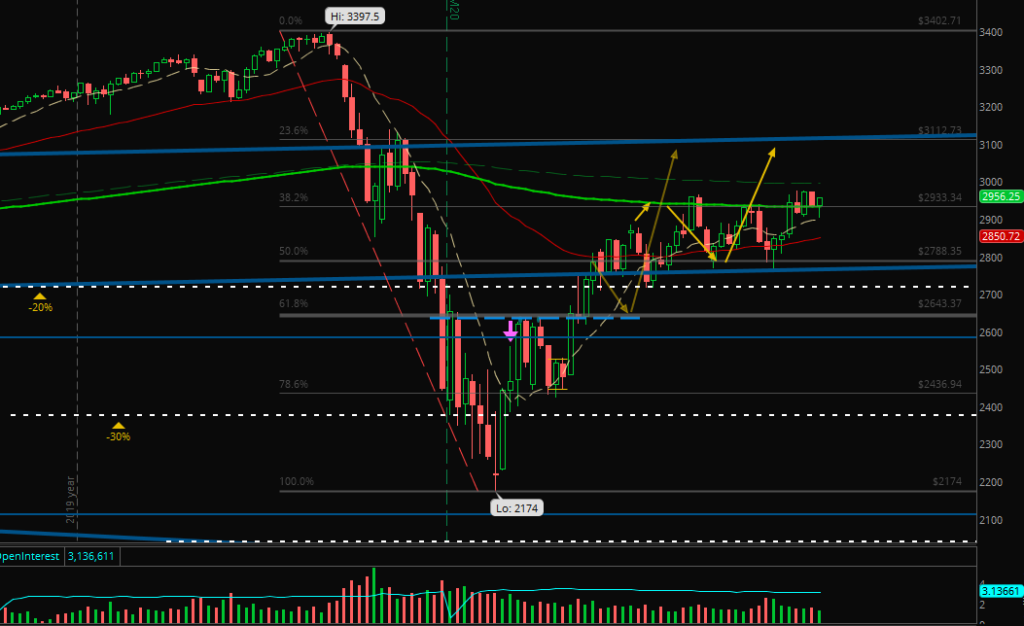

The last week lifted the market above the 61.8% level. But will the run above continue? Will we touch the top of the monthly channel?

Market Ideas

The break above the 61.8% is done (scenario (1) of last week). But we had a sideways movement on 4 of 5 days.

Now Monday will be a short day for the futures because the stock market is closed. Being in the middle of the channel between 3100 and 2800 I see two possibilities with each at 50%:

1. Break above and the touch of the top of the monthly channel or

2. the bulls will get weaker and we’ll break below to 2800 and/or lower.

I tend to at least a try to get the top of the channel and of course, it will go down sooner or later. But if it will happen after a bullish top or now as a rounded reversal?

It’s most interesting how the European market will open tomorrow to get more information about the market sentiment.

Portfolio Talk

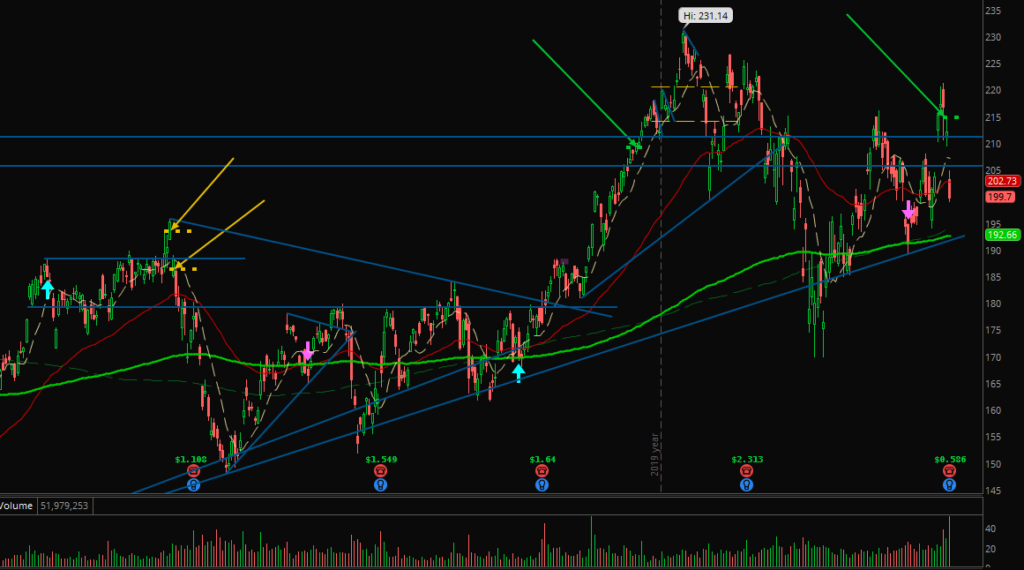

This week the news came out that there’s the possibility that for stocks of companies from China will be a delisting soon. I wasn’t sure what to do with BABA (Alibaba Group), so I watched the price action. Therefore I missed the first move down but then it reversed a little up and I decided to close half of my position, some minutes later the rest of it.

For me it’s always important to decide with good reasons because I have to like my decision if the stock will rally up or fall down. My reasons were:

- I do not understand all about a delisting, so I do have an unknown risk that I do not want to take.

- I already had good profits with the second partial of my investment.

- I’ll take the profit and if there’s no delisting, I’ll buy cheaper or cheap at the next low.

So I did and I must say that I picked a good point on the chart:

My entries were really bad but it was bought as a medium term investment. With a good profit at the first “risk-out” target, I wanted to let the second partial run.

Now the situation and the chart of BABA isn’t very clear, so maybe it’s a good point of closing the position.

Especially after bad earnings came out after I exited. 🙂

Futures Experiences

I would say my trading week in the futures was really good. Almost little better than the last one. Only on Friday I wasn’t focused and took a first trade without a “best setup” and it failed.

So, I paid for a mistake. But above $50 per week is still a nice result because I do trade the MES (started with the MNQ, then both, now mainly the MES). And if I can make my $50 per week in the MES (the micro), I can switch to the ES (the mini) and make $500 with the same trades and targets. Then just double the contracts and it’s $1k per week. Same setups, same targets.

But first I have to be consistent for many weeks in paper and with live trading to change anything:

Last Week:

• Live account: +$0.00 (no live trading)

• Paper account: +$59.50 (3 green days, 1 break even, 1 red day)

This Month (May):

• Live account: +$0.00

• Paper account: -$4.46

[all amounts after commissions and fees]

You know I do not want to watch the dollars but it would be nice to finish May positive next week. 😉

Of course, I had much bigger results in paper yet. But this month is the first with really good setups and repeatable results.

I wish you the same!

So, will we touch the top of the monthly channel next week? I do not know but I will day trade what I see.

Stay healthy and happy!