The market is still on its way up and I want to know your opinion: Is it risky to try a new strategy with real money? Read about my newest changes in portfolio and some experiments below!

Market Ideas

The market was strong enough to break above the counter trend line I wrote about in last week’s article. So, we’re a little bit higher now and maybe on our way to a new all time high.

But as you can see in the chart, there’s a resistance or more like a magnet around the current price level.

So, I wouldn’t be surprised if price stays some more days at this level or moving down to bounce on the top of the channel.

Pay attention on a candle close above this little consolidation or below any of the trend lines.

Portfolio Talk

And now I let you know about all my changes in my portfolio:

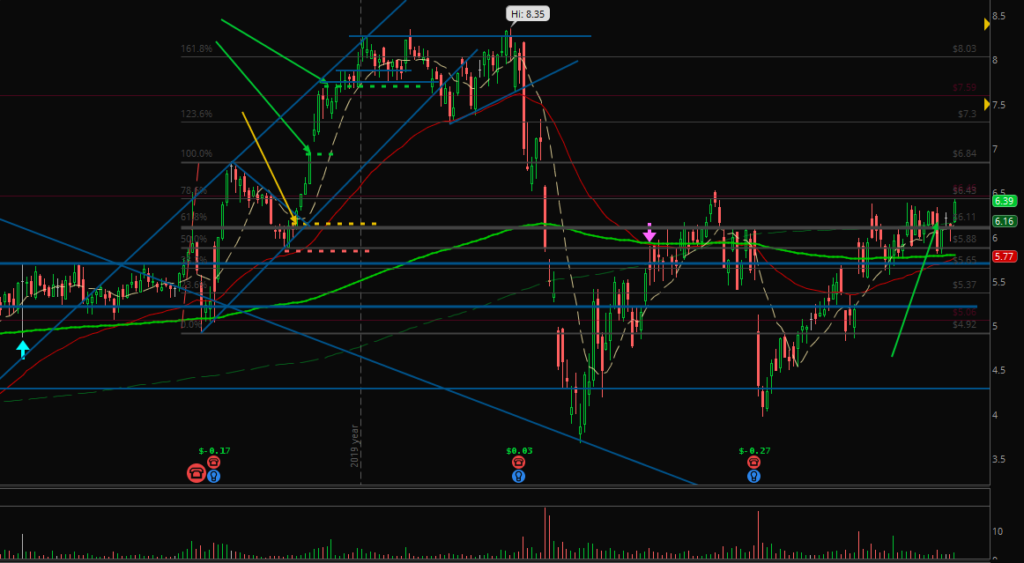

With INFN I had a really strong swing move and I soon had the profits of my first two targets.

Then I was too confident of this stock – because it had a nice move after a huge low as you could see in a weekly or monthly chart. So, I hold it through the correction and had to go through the loss area with the last partial. After it didn’t break higher with the overall market I decided last week to sell at break even with a profit of some cents.

Although on Friday it had a big bull candle I am happy with my decision because I do not want to hold such “hope” stocks anymore.

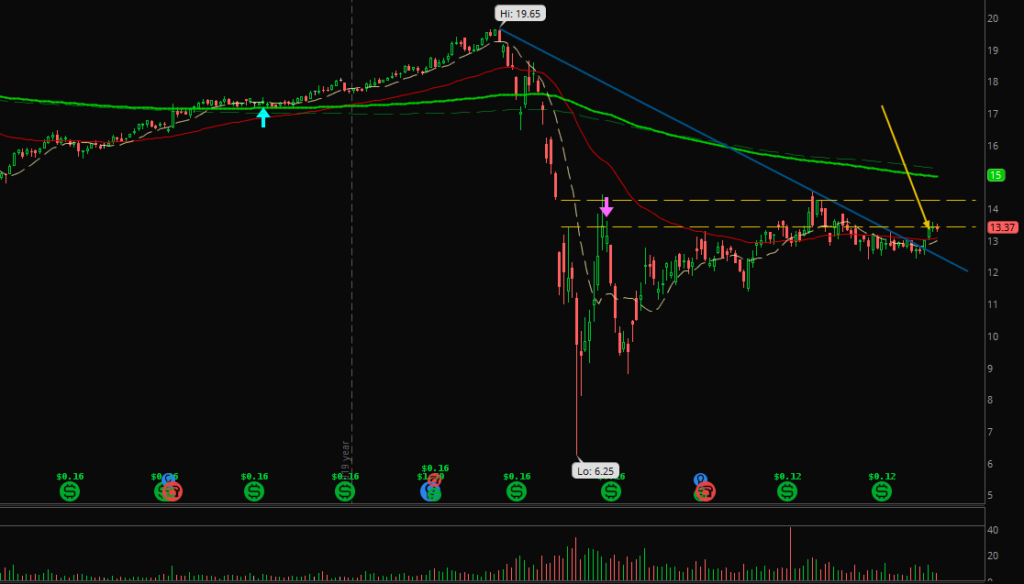

I bought AMZN with the expectation of a break to the upside but it decided to stay many months in a range before it happened. But my patience paid out!

Last week I felt that it was time to sell and use this big profit to increase my cash another time to have the possibility of buying lower – because the market is overstretched and I still have enough other stocks to profit if market will go higher before the next bigger move down.

AGNC is the first one of three stocks I bought last week after developing a little new long term strategy.

I first thought about writing about what I read in some papers about the work of Warren Buffet but because it’s already Monday morning and my time isn’t endless I have to put it back for the moment.

The strategy is based on “boring” undervalued stocks with a potential of consistent growth. And I do like to take some risk from time to time with such experiments. Yes, I used real money for it but really small positions for each. Whatever is in my real portfolio is watched and analyzed much more than anything else. That’s just a fact. Am I the only one?

So, to answer the question: Is it risky to try a new strategy with real money? No, I don’t think so, if the effect of learning and improving is worth the calculated risk.

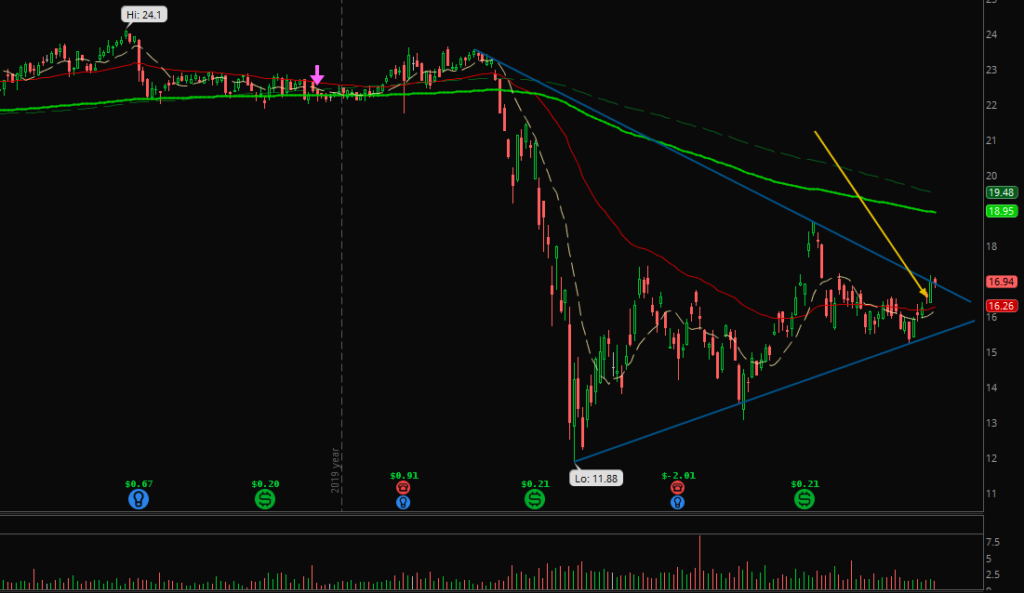

ORI is the next one and the one with the best performance last week of the three.

And with FULT the three are complete.

By the way, I made around $0 with them at the moment. 🙂

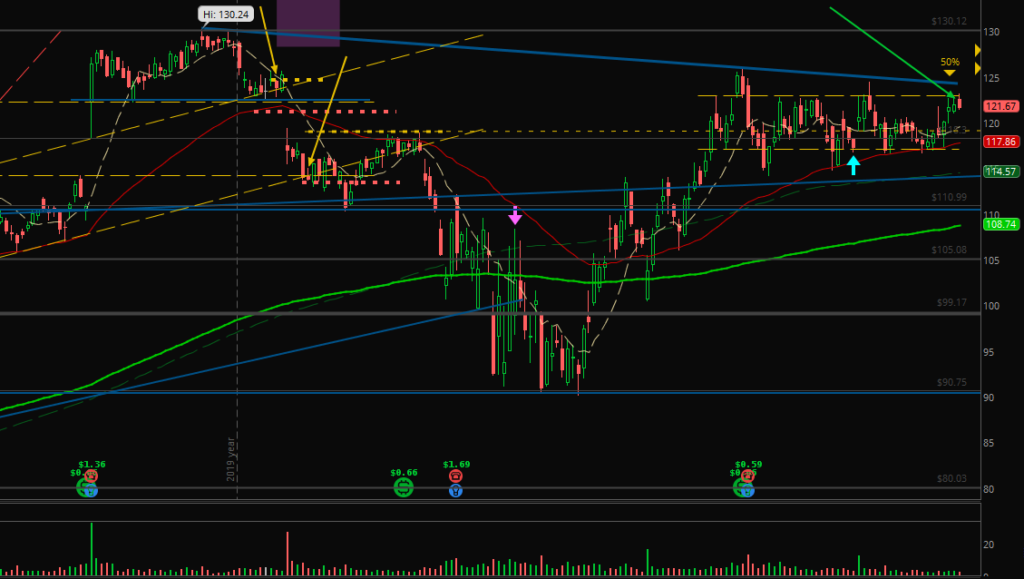

And with TGT I finish the view on my portfolio.

I started it as a nice swing after a big gap and strong candle. Then it fell down – and gapped down – but I liked the setup, so I added to it. And then? Yes, the correction started. I had to take some heat but I liked the numbers and the fundamentals of the company, so I hold it. But it was too much capital blocked by this position.

And because I am not sure if market is strong enough to support TGT to break out of this range soon, I sold about 50% at the top of the sideways move – it already was a nice profit.

Now my cash has grown a lot and I am prepared for some nice new positions at a low. May the move down come this week!

Futures Experiences

With the futures I focused on IB (“free approach”) this week but paid attention on not trading with too much risk and too many contracts. I cut the freedom to more realistic trades and I still like the results:

Last Week:

• Paper account: +$0.39 (2 break even, 3 days not traded; MES)

• Free approach: +$335.00 (3 green day, 2 days not traded; originally traded in ES as +$3350)

This Month (June):

• Paper account: -$86.97

[all amounts after commissions and fees, live account still pausing]

With a weekly profit of more than +$3k in the ES I would have much more than I need for living. So, I feel more and more that it’s better for me to take some hours off and do not watch the market if I see that the market is choppy or indecision.

Every day and every hour has its opportunities. So, I just can take the ones I like and I see a really high probability of success in it.

While I am writing these lines I just “missed” a move of more than 10 points. But I do not feel bad anymore. I marked the move before and thought it would move like that. But I wanted to write this article first, so I am happy with it.

And maybe that’s the reason for the change from bad trades to good trades: I am relaxed, I am not gambling. I just know what I do and what I avoid. And I do it like that.

Next step is to transform it slowly (I would never jump 100% to real money again) to my live account.

But maybe I’ll start after the next article.

Do you want to write a comment with your opinion: Is it risky to try a new strategy with real money? Do you also love some little risky experiments?

Stay green and healthy!

2 Comments

Alessandro

(20. July 2020 - 20:47)Very interesting article Alexander, like always….

I would never dare to trade with real money a new strategy, unless I have at least a one year period of backtest, of at least 100 trades (however after my experience, I think at least 300 would be better)…..

since you have collected already several years of experience with futures, and surely you have more than enough confidence, the only thing that could not let you be successful, would be the psychological component, of risking your real money….

but I wouldn’t doubt on your strategy itself!

Alexander

(26. July 2020 - 13:45)Thanks for your thoughts! Next articles will follow soon. 🙂