I’ll explain again why I buy new positions with strategies I didn’t tested long before. Do not risk your capital without thinking about it! Also, you’ll find my changes in my portfolio and my mistake in the calculation of the futures statistics below. Happy reading!

Market Ideas

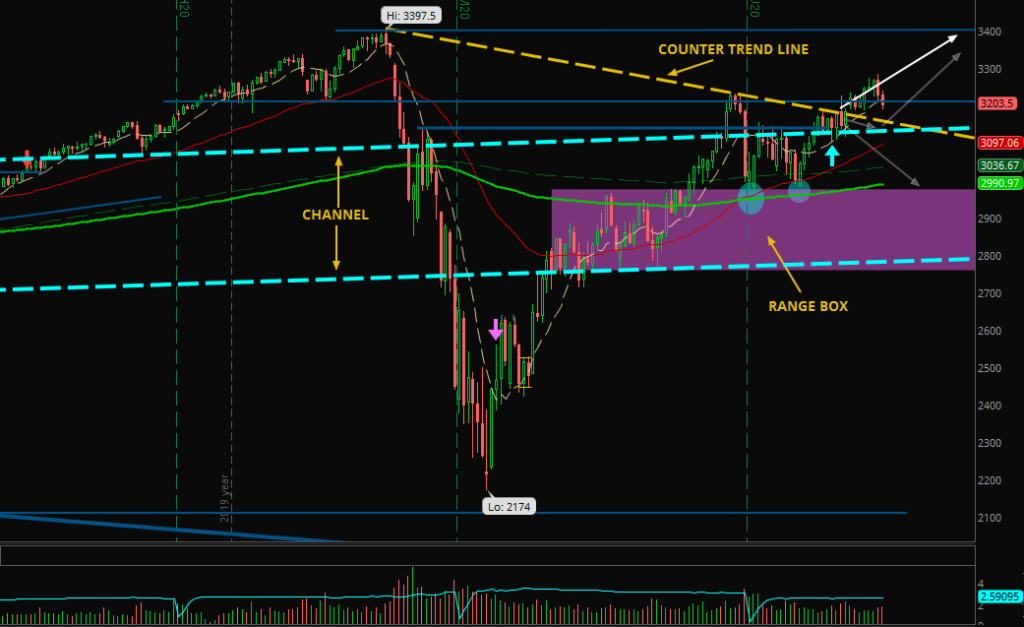

What should I say? Same as last week? Right. We’re above the counter trend line (CTL) and the channel and the moving averages. Before anything is broken, price will go up.

But: For me, it feels that the bears are getting stronger each day. I wouldn’t be surprised if the big sell-off will start soon!

Portfolio Talk

Because in my opinion the market will turn down soon, I decided to get out of two more positions last week:

For DEA I missed the perfect profit-taking-level at the top. I made the 2 profit targets, decided to hold the last little partial through the low but now I wanted to get rid of it at break even.

Maybe it moves – like INFN after I sold it the week before – upwards the next weeks but I do not want those hope-trades anymore. Sold, out, new opportunities will follow.

Same explanation for COLD: I had a huge profit with COLD and then I entered again after this nice pullback but it wasn’t the low and it was week over so many weeks and months.

Yes, it looks like there’s a high probability of higher prices but I didn’t get in at first to hold it for such a long time. And I prefer cash for interesting new positions than holding old stuff in my portfolio. Also: Out, little profit, good bye!

But also, I bought 2 new positions. Both for testing new longer term strategies on a fundamental basis …

… like KB in addition to last week’s new positions (AGNC, ORI and FULT) …

… and LHX for a second but also new fundamental strategy.

Some of you wrote me that I sold so many positions to have cash to buy low and cheap and now I have 5 new positions without waiting for lower prices?

Yes, you’re right. But the new positions are all just trials. All together they block less capital than one of my smaller normal positions. Just experiments. They moved about +2% up and back to break even in these few days but that’s only a few dollars.

Do not risk your capital with experiments! That’s not what I wanted to say. It’s just me who likes the feeling of real money positions. But maybe I sell them all 5 as soon as a clear pattern to the downside will show up!

Futures Experiences

While preparing the numbers for the futures statistics I recognized that I forgot to switch the month from June to July. So, the performance this month is small but nice (all profits calculated in or for MES):

Last Week:

• Paper account: +$1.38 (1 little trade, 4 days not traded; MES)

• Free approach: +$45.40 (4 green days, 1 day not traded; originally traded in ES as +$454)

Last Month (June):

• Paper account: -$150.90

• Free approach: +$256.20 (+$2562 in ES)

This Month (July):

• Paper account: +$65.31

• Free approach: +$432.40 (+$4324 in ES)

[all amounts after commissions and fees, live account still pausing]

This week I did only trades that I could easily be traded live. Only 1-2 contracts, just little moves, not much heat.

And almost $500 are nice. I had no loss and traded not often.

Let’s see if I could do one of my next week’s trade live. But Thursday and Friday I have to trade in our camper because we are on tour for 2-3 days.

You see, my futures trading becomes boring. The best sign on the way to consistent profitability, I think. 🙂

Now you know: Do not risk your capital without thinking about it! But you knew that before. You only think that I am pretty crazy. 😉

Stay green, crazy and healthy!