It’s just a short article this week but with a review of my new positions and the new futures statistics.

But like every week: Read about my trades and thoughts!

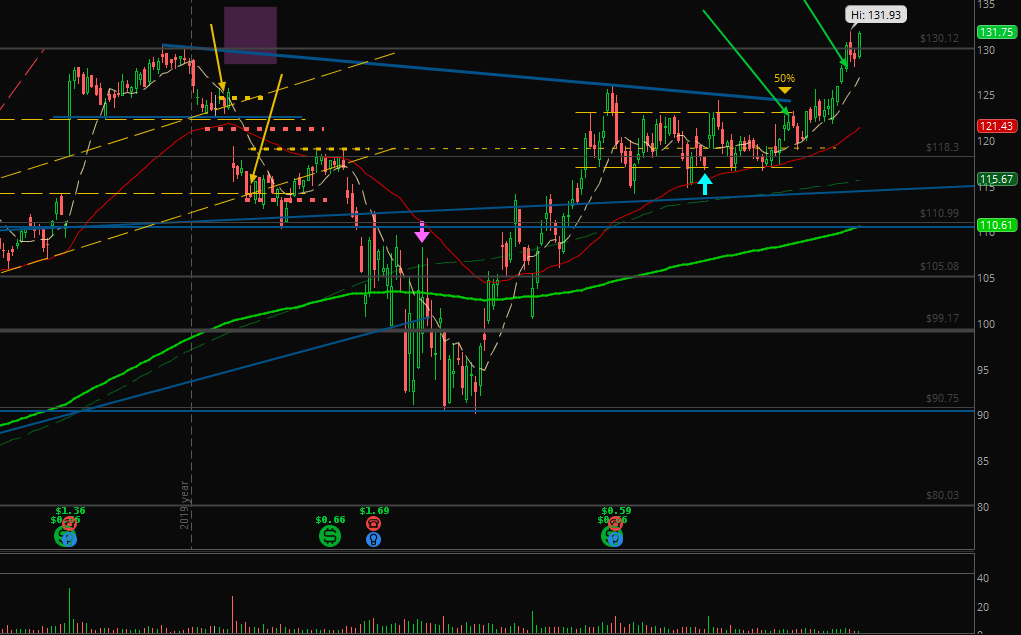

Market Ideas

The market moves upwards as we watch it and expect it for many weeks now.

In my opinion, the probability is high to see a new all-time-high soon but I don’t think that we’ll stay above the last all-time-high around $3400 for a long time.

Portfolio Talk

Just one change last week:

Because my position in TGT was still too big, I decided to sell another partial. I think I can use the money for better returns in other positions.

And maybe you’re interested how the last positions of my new long term strategies work:

• The four stocks (AGNC, ORI, FULT and KB) are all positive and together at +1.2%.

• The other approach with LHX is at +1.3%.

• BAC followed by Buffet’s additional buys at +7.3%.

So, I am happy I started those. I’ll keep you informed about the performance over the next weeks and months.

Futures Experiences

Last week I also had two days with just 1-2 hours at the computer and made my profits in this short time. No losers, only green trades and days:

Last Week:

• Paper account: +$22.76 (1 perfect move, 4 days not traded; MES)

• Free approach: +$137.40 (4 green days, 1 day not traded; originally traded in ES as +$1374)

Last Month (July):

• Paper account: +$82.81

• Free approach: +$525.70 (+$5257 in ES)

This Month (August):

• Paper account: +$22.76

• Free approach: +$137.40 (+$1374 in ES)

[all amounts after commissions and fees, live account still pausing]

Of course, I am a bit nervous about what will change when switching to real money. So, I know, I have to start slowly and soon. But I think I feel when it’s the right point of time.

Stay green, experiment with new strategies and approaches in paper and stick to your rules in your running portfolios. I hope you’re inspired from time to time to read about my trades and thoughts. A healthy and happy week for you!

2 Comments

Paul LaRocca

(9. August 2020 - 19:16)It’s great to see all positive results!

Alexander

(16. August 2020 - 13:57)Thanks, Paul!

I am happy about it, too.

Especially this week when I thought that I traded too less and took one more trade on Friday to get a better weekly performance and it was a nice winner!