The market moved like expected and a new higher high was built. In the following article I write about the market overview and how I tried a week with bracket orders for my futures trading.

Market

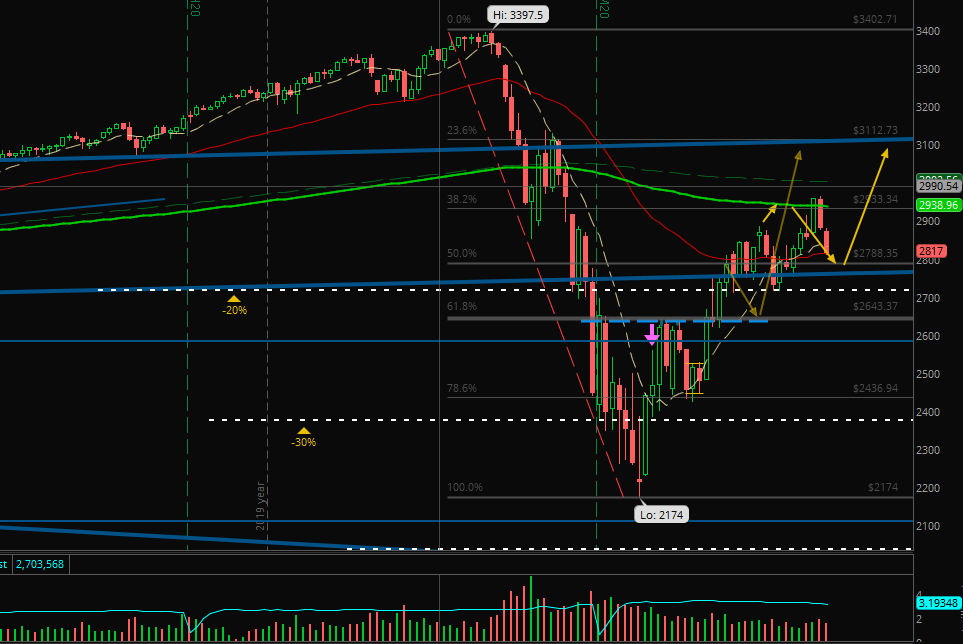

Here again the daily chart of the ES, the future of the S&P 500:

I do not expect anything different. We made the bounce around the 200 SMA / 250 EMA and touched the 50 EMA again. As I explained the last two weeks I expect price stays within the monthly channel.

So, I will try to catch a part of the move from 2800/2810 at least to 2900 or the 61.8% Fib. level of the correction.

Futures

I couldn’t reach my goal of last week. Monday I had a big loss again. My conclusion was that I started too confident in the new week and was too focused on the current candles than to pay attention on the big picture:

Last Week:

• Live account: +$0.00 (no change)

• Paper account: -$179.77 (2 green days, 1 break even, 2 red)

Last Month (April):

• Live account: -$100.08

• Paper account: -$181.70

This Month (May):

• Live account: +$0.00

• Paper account: +$8.91

[all amounts after commissions and fees]

Because I analyzed the data the week before and I had again a bigger loss on Monday I decided to give bracket orders a chance. I started with a 2:1 bracket (-2 points for stop and +5.75 points for target, 2:1 after costs) and continued this until Friday afternoon.

For the last hours I tried a wider solution and traded the MES instead of the MNQ.

To make it short: It was a very enriching experience and I will continue next week. Especially the 2 point stop is a challenge but comes along with a high learning effect.

Also, I decided to continue paper trading until I have a week with 5 green days and every day with really good setups. It’s a hard condition but I want to live from my profits and I do not want to risk more of my real capital with inexperienced trades or trades full of mistakes against my rules.

But Thursday was my best day ever: I was patient and had just one trade with a really good setup, a hard stop of 2 points and a winner. Maybe I can repeat such a day twice next week?

I was asked for some hints: Create a document with all your rules and work on it at least every week, see it as a possibility not to trade, focus on the best setups patiently and prefer the signals on higher time frames to those of candles on 2-minute- or 5-minute-charts.

What about also trying a week with bracket orders?

Stay healthy, and trade better than me. 😉