What a difficult price action! I am not sure at the moment where or when I will start trading swings again and futures day trading is a big challenge in this high volatility environment. But it’s a great experience after the weeks of strong bull market.

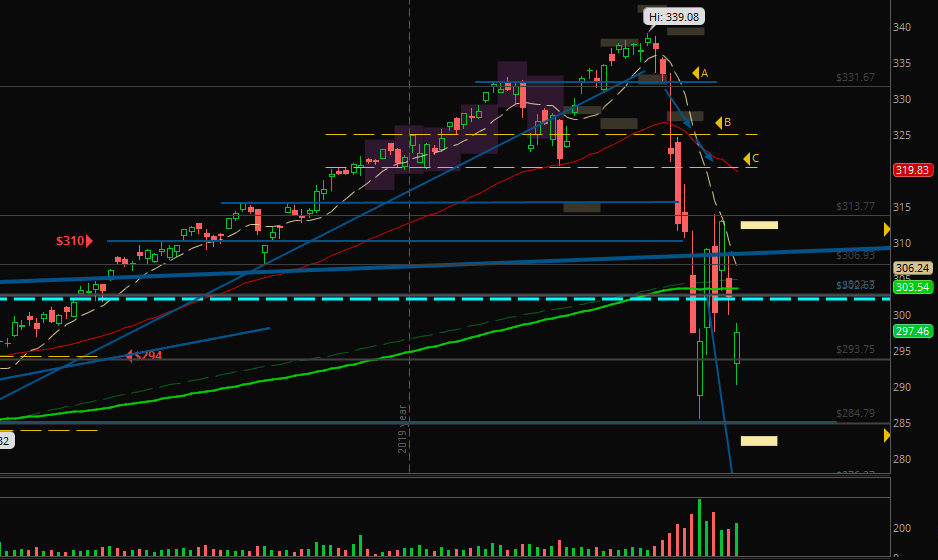

Now I see at least two possibilities: There will be a double bottom or price action will go down like a waterfall …

Candles bigger than 25 candles last autumn!

Long shadows in the small time frames and huge candles in the daily chart. I never had such a price action in my trading journey.

Last week the upper limit of the expected move worked as resistance and we had a range like movement. Now we have to break above the 200 SMA and the resistance around $302.

As you can see the expected move is a big one for the next week and especially at the limits (marked in bright yellow in the chart above) I will pay attention what price will do.

The green candle of Friday was created by a steep move upwards before EOW (end of week). So, it’s possible to see some bullish days but at this level we should also expect lower lows.

I will wait for trading swings until I can see a clear bottom. The highest losses are in the financial sector and when you watch the weekly chart of the XLF, you can see that it almost bounced on the 200 SMA. The VIX (index of the volatility of the stocks in the S&P 500) had reached more than 50 (higher than during the correction in 2018) and we’re still at 42!

So, be careful with signals to both sides, calculate with the volatility when using stops and let’s wait for the next candles to get a clearer picture.

My cautious step with a next long position

After my position in MSFT last week I bought another small position in AMD on Tuesday. I thought we would go little higher, so I had set my stop loss at break even but it was only an up and down around my entry.

I won’t risk much although I bought it long term. But for me, there’s a too high probability of much lower prices, so I don’t want to see this buy as a good partial for long term if we won’t recover.

I have to admit that I did no homework since the correction at the end of 2018 when I planned to learn all about hedging and select one method for my accounts.

So, my long term account has lost as much as my trading account – on a percentage base. I do not have big cash reserves for buying at the lows if we’ll see a bigger bear market.

I hope you did much better!

Do you know that we speak of a bear market when there’s a correction of -20% and on average it then goes down to -30%? On average. It could be just -20% or -50% …

By the way, my week with real money in the futures was … eh, not so successful. Because of the high volatility an experience futures trader had probably paused trading and no one would recommend to switch to a live account in this environment. But I again learned a lot and I will continue on Monday. 🙂

What do you think? Double bottom or waterfall price action?

I am excited what you think will happen the next weeks. Write a comment or send me a message or email. You’d make me happy! 😉

Now I wish you the smallest draw down for your accounts and a happy, healthy and successful week!