The last week I started to combine the free approach of my day trading experiment with my rules and disciplined trading style. And it was a really good week. So, I’ll write a little bit below about finding my own style of day trading.

And thank you very much for the enriching comments below the last article. I am always smiling when I see that a new comment was written. 🙂

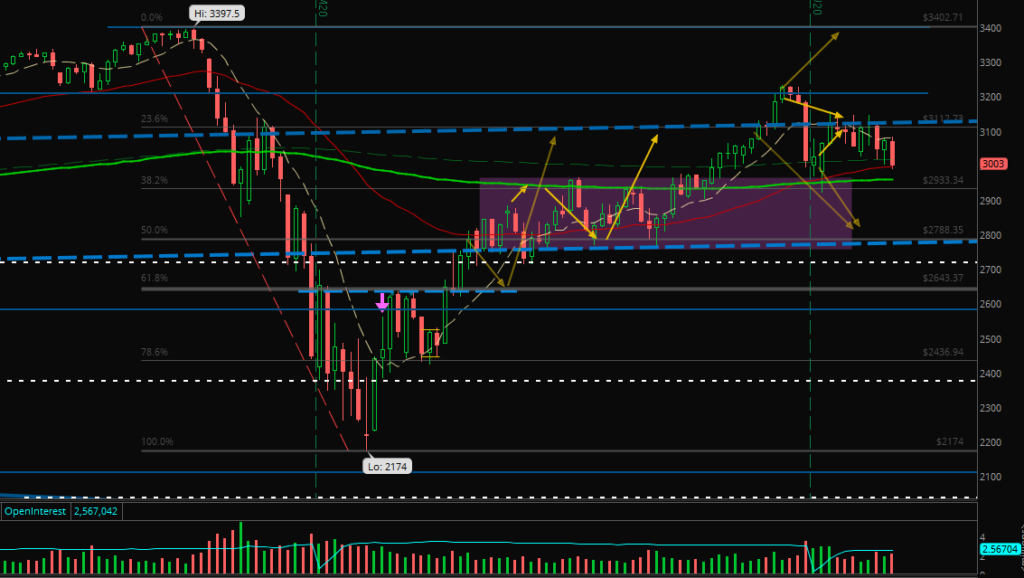

Market Ideas

What should I say? Market is moving down after some sideways price action like I expected last week.

And I could write more but obviously I won’t change my opinion and for me, it’s still most likely that ES will go down to the bottom of the weekly channel and touch 2800.

Portfolio Talk

My portfolio also didn’t change a lot the last week. I just sold another part of EDIT almost at its high on Tuesday to transform risky investment into cash.

All the other positions I will hold through the next low – unless we’ll see higher highs before.

Futures Experiences

Like mentioned above I combined both styles of trading – the free approach of my experiment of the week before and my rules developed over the last 6 months.

And here I am. Much better results:

Last Week:

• Paper account: +$59.40 (2 green days, 3 break even, no red days; MES)

• Free approach: +$256.20 (5 green days; originally traded in ES as +$2,562)

This Month (June):

• Paper account: -$150.90

[all amounts after commissions and fees, live account still pausing]

With my free style without bracket orders and more open to any setups I strengthen my self-confidence because the win rate is enormous. It’s good to know that my knowledge about pure price action is at a high level.

I “only” have to find the best fitting money management for my trades. Because of that I’ll still need many weeks and months until I can trade consistent profitable.

But the last week I didn’t take too much heat and only used 1-3 contracts for the trades. So, it was a realistic paper trading with around +$300 in MES or +$3k in ES for one week.

It’s often hard to continue working on finding my own style of day trading but also it’s so exciting to develop a system fitting to myself in every little part. And although I am trading for such a long time now I am learning new aspects almost every day.

I hope you’re still interested in my journey to profitable day trading while reading about my other portfolios and expectations for the market. If you have questions or other ideas, just let me know!

I wish you a healthy and successful week!

2 Comments

Paul LaRocca

(27. June 2020 - 19:19)I am bullish on your trading future!

Alexander

(27. June 2020 - 20:20)Oh, thank you so much!!

So you’ve bought some call options on my future’s returns? 😉