Either my analysis becomes better or I just had luck. But my expectations came true. Read about this and the glide above the 50 EMA and 50% below.

Market

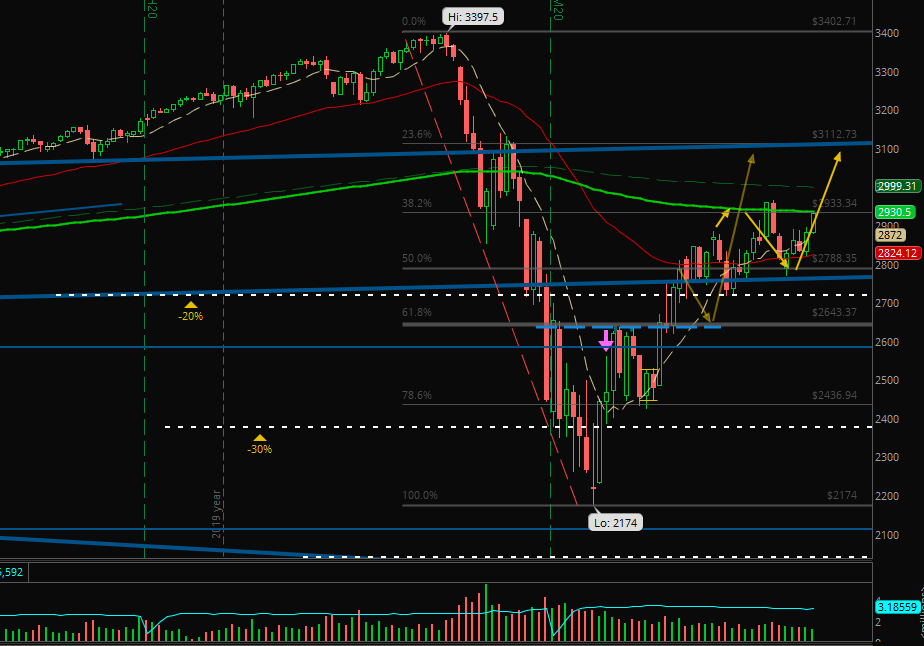

The yellow arrows are from April the 19th and the market moved exactly like them.

But above there’s the 200 SMA and before the 250 EMA as resistance and also we are below the 61.8% Fibonacci level of the correction from the low. So, it will be hard to break above.

I am almost sure that we’ll stay longer in the channel of the last months, even years I already wrote about. But maybe we’ll test the 2800 again before breaking above to 3100.

However, the last two candles were long bullish candles without significant shadows. So, let’s see what next week’s price action will show us. If Monday will start with a little move to the downside, not more than half of Friday’s candle and then turning up, it is very likely that we’ll break the 61.8% level. If the resistance will be tested immediately I would say that it will fail.

Futures

Last week was again negative – again with 2 days of bigger losses couldn’t be recovered by the winning days – but I came to some important psychological factors I am now working on. Not obvious ones written in trading books and very individual to my personality.

I noticed that my technical understanding and the trades itself are very good but my mind is working against my plans in some ways. So, on one side it’s hard to work on them, on the other side it will change my performance significantly:

Last Week:

• Live account: +$0.00 (no change)

• Paper account: -$126.42 (2 green days, 1 break even, 2 red)

This Month (May):

• Live account: +$0.00

• Paper account: -$117.51 (+$20.25 before costs)

[all amounts after commissions and fees]

Two important changes for the next week are that I will shut down all channels and social media to other traders to focus on my plan, my ideas and my trades without any influence from outside.

And I will try to trade one trade per week with real money. Because I told this a friend of mine in a talk about the emotions between paper and real money. I do have my experience with live account trades but I do not want to lose this knowledge over time. Also, it will set my focus to the best trade of a whole week.

Another change will be that I do not focus on 5 green days but “just” on playing my rules and trading wisely and responsibly.

Watch out for the glide above the 50 EMA and 50% below, especially the move on Monday and stay healthy!

Best wishes for the next week!