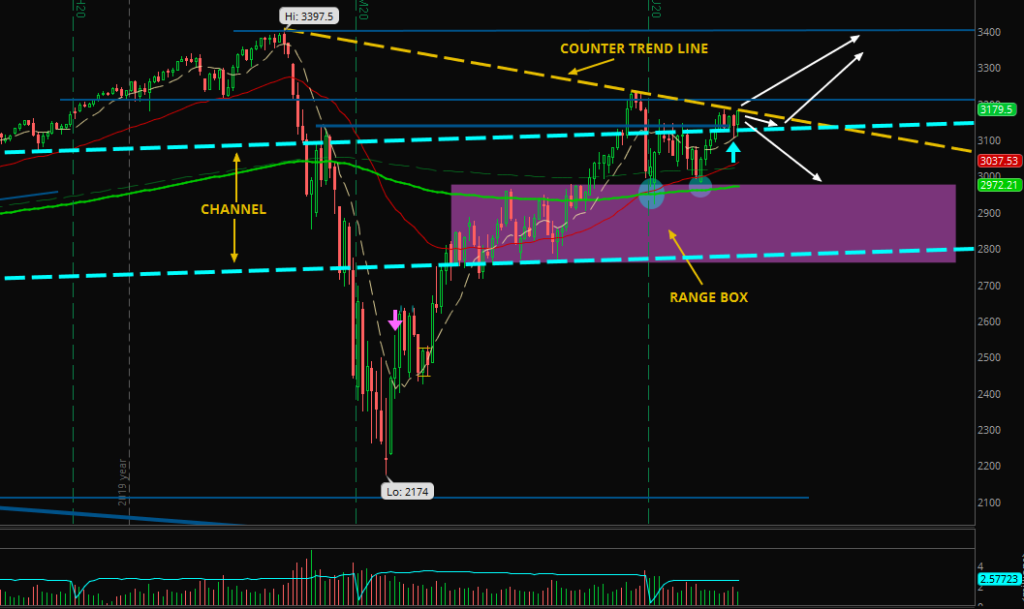

You’ll read this week about what lines were most important for me and what moves are possible while the market is caught between trend lines:

Market Ideas

As you read last week I underestimated the importance of the counter trend line (yellow and dashed; yes, I added some annotations for you!) and I overestimated the channel (in bright blue).

We didn’t broke to new highs but also we didn’t stay in the channel. Now it’s difficult to predict the following move. We have at least 3 possibilities:

- Break above the counter trend line on Monday or Tuesday as continuation of the strong close last Friday.

- More sideways price action before breaking above. The counter trend line was always a strong resistance during the day trading sessions.

- Back to the channel to the top of the range box.

In this situation with market being caught between trend lines we have to wait for the start after the weekend. The strong move upwards on Friday could lead to higher prices, so this would be the only signal for the next days.

I would wait for a clear close above the counter trend line or back in the channel to base trades on any prediction.

Of course, I am still waiting with new long term positions at the moment at this level and the swings also didn’t change last week.

Futures Experiences

The futures results are looking a little boring:

Last Week:

• Paper account: +$30.52 (2 green days, 3 days not traded; MES)

• Free approach: +$12.90 (1 green day, 4 days not traded; originally traded in ES as +$129)

This Month (June):

• Paper account: -$87.36

[all amounts after commissions and fees, live account still pausing]

But I didn’t spend lots of time in front of the chart but the performance is positive. And every trade I took the last two weeks was a winner or at least break even. I am happy with my picks.

And I am also working on more automation – for the upcoming vacation season – and to find and improve more clear rules for my long term investment.

Next week I plan to trade more – even though I already have a lot of other tasks to do – and to get some more returns.

Thanks again for listening my thought!

Enjoy the trades, life and the sun and please, keep healthy and happy!