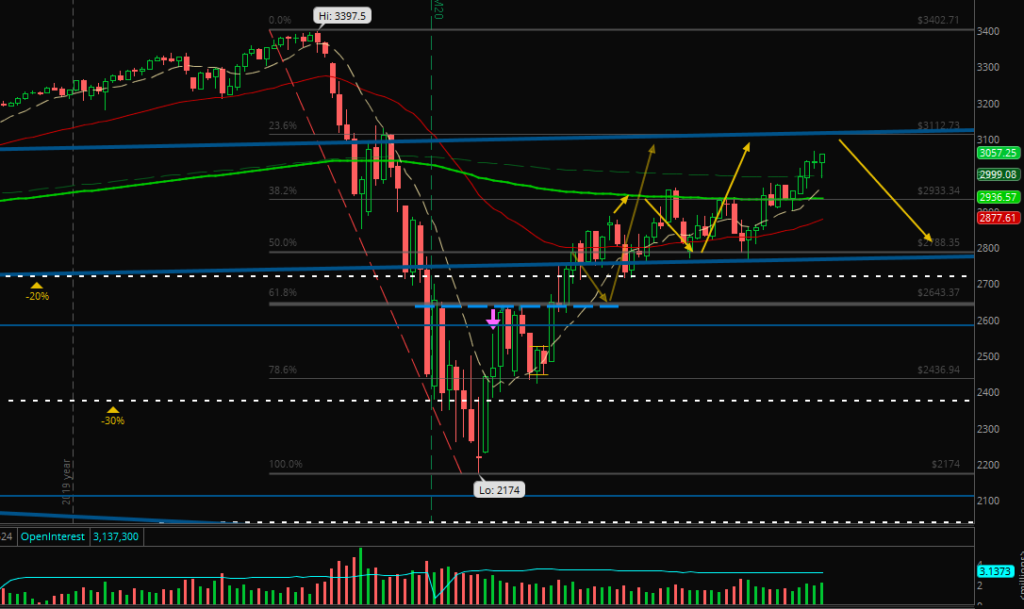

Markets are bullish and on the way to the top of the monthly channel you know from my last articles. So, next week we’ll hit a new high and will turn down – range or downtrend?

Market Ideas

Scenario (1) of last week came true. We broke the moving averages and price is on it’s way to the top of the monthly channel at around 3100 in ES.

So, it’s not a mystery what I expect if you read the last week’s articles:

We’ll touch the upper limit of the monthly channel at little above 3100 and then we’ll turn down to the moving averages and most likely back to bottom at 2800.

Because I had no changes in my portfolios this week I’ll jump over to the futures immediately:

Futures Experiences

Below you see that anything don’t want me to win already. Compared with what I am learning through this period of trading it totally makes sense. But a positive month had just been “nice”. 🙂

Last Week:

• Paper account: -$158.89 (1 green day, 2 break even, 2 red days)

This Month (May):

• Paper account: -$163.35

[all amounts after commissions and fees, live account still pausing]

On Monday I didn’t took a trade and Tuesday and Wednesday were full of losses although I anticipated the right direction and moves but just late entries – too cautious after 3 day more or less paused trading.

Thursday and Friday weren’t good enough to recover anything. Of course, in live trading I had stopped after two losses and the overall loss had been smaller.

But I am happy that my paper trading has come to a realistic level where I can work on everything and if it will work then I can adapt everything to live trading.

Next week I’ll try a tighter stop level for one of the 2 contracts I trade and I will completely dispense shifting my stop to break even. I analyzed my past trades much more in detail with Python graphs and calculations to watch the win rate without adding break evens to winners and watching MES and MNQ values separate.

I recommend doing all the statistics you can do to get a better view on your overall trading. If many of you would be interested in a new article about coding trade statistics with Python I would write my work down for you. Just comment below.

That’s it for today. Short but I hope useful for most of you.

Stay healthy and enjoy the week!