Because I sold some of my medium term positions and I learnt to wait for the best setups in the futures, I decided to name this article: Take profits and always be patient.

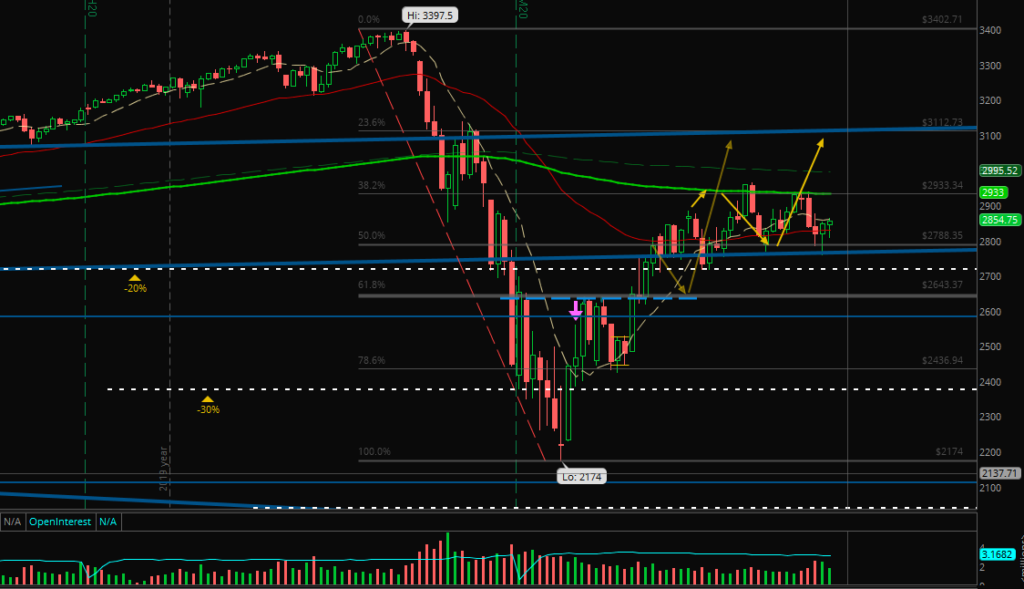

But first let’s watch the S&P 500 future, ES:

Market Ideas

Market tried to break the 61.8% level on Monday, Tuesday and Wednesday and then fell down to test again the lower limit of the monthly range I expect(ed) price to stay in for some more days.

For me, two scenarios are possible:

1. A break above 61.8% followed by a top around 3000 before turning down again.

2. A break of the 2800/2750/-20% level to the downside because of the double bottom price built.

Because it is 50% chance for both possibilities, I decided to take some profits to have cash for the next bottom:

Portfolio Talk

I already have some positions running, so I won’t miss a move to the upside but I wanted to be prepared for the next move to the downside.

Here are the three closed positions:

a) Maybe the longest trade I ever had: MKTX

It was a nice setup in March 2019 and price went up with good profits, so my 2 targets were hit within one month. Then I had a (very small) third partial open and decided to let it run.

After I missed the top on 9/5 in 2019 I set my stop at the red line. As you can see I had some luck on 3/20 in 2020. And after this nice run I did not want to risk my profits and sold at a good profit on Monday.

b) Second chance for a better entry: MSFT

After I went through the low with MSFT and AMD I decided to sell my latest medium term positions to get some cash out of it for the next lows. Maybe a better entry for MSFT or anything else.

But although it wasn’t the perfect position I got out on Monday and Tuesday (each 50%) with a nice profit.

c) Struggling at the highs: AMD

For AMD the reasons are the same but in addition to that the highs were sold and I do not expect that price will reach higher highs before the next bigger move down.

With Infineon Technologies (IFX), a leader for chip technology from Germany, I already have a position of this sector in my long term portfolio. So, I use AMD for “medium term” as I named it.

With these 3 closed positions and my running last third in ACM (short) I am prepared for the next low. 🙂

Futures knowledge

After working much harder on my rules and psychological factors, the last week wasn’t only a green one – all days finished green:

Last Week:

• Live account: +$0.00 (no change)

• Paper account: +$53.55 (4 green days, 1 break even)

This Month (May):

• Live account: +$0.00

• Paper account: -$63.96

[all amounts after commissions and fees]

More important than the profits is the quality of setups for me. And the quality was extremely high. I was patient, traded far less than the last weeks and entered only when everything fit together well.

A new experience and I hope I can continue the next 5 days.

With these words I will finish the week and I hope you could also already profit from the correction and the latest rally?

Stay healthy, take profits and always be patient!