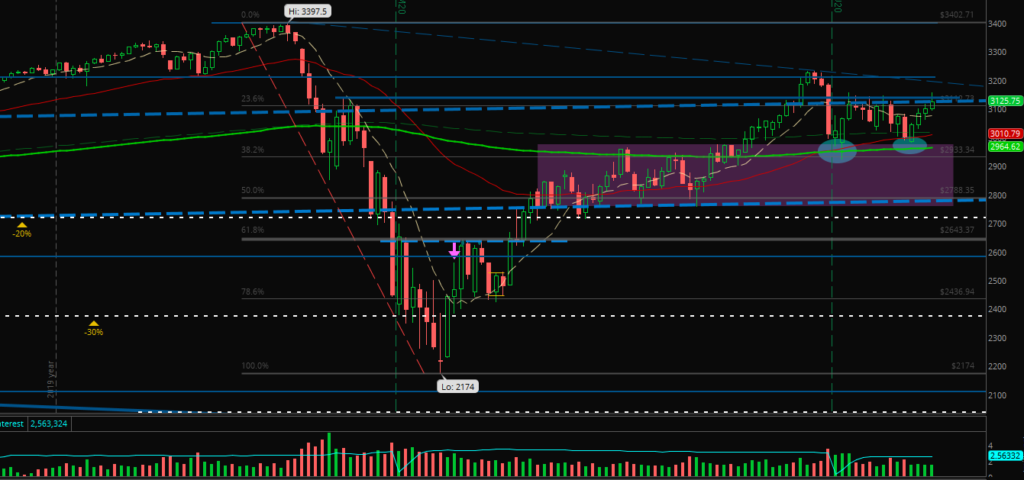

Every one to three days of selling are followed by bullish candles. Although a longer correction would be healthy, the bulls now seem unstoppable.

Let’s find out what possibilities we have for the next moves:

Market Ideas

We have several important support and resistance lines:

- the monthly channel (blue dashed line)

- the last range (purple box)

- the first lower high of the big correction (line next to the top of the monthly channel and through the upper shadow of the last candle)

We are in the big channel, testing the top again. We bounced two times above the range box – what I didn’t expect last week. And we tried and failed to break above the correction lower high.

What does that mean for next week?

For me, it is more likely to come back to the top of the box than to break above the channel top. But also, it’s not very likely that we break into the box.

So, I expect a ranging market next week with the first days coming down to around 2975.

If we’ll have positive new, there could be a break above on Monday or Tuesday, of course.

Because of the indecision at this relatively high price area I did not buy or sell anything of my portfolios.

Futures Experiences

Last week I traded really relaxed, worked a little bit on my live trading bot – which had good profits over the week – and I just took some nice and small trades in the Tradovate and Interactive Brokers account.

But although I took just very few trades I had no loser last week:

Last Week:

• Paper account: +$33.02 (1 green days, 4 days not trades; MES)

• Free approach: +$39.10 (2 green days, 3 days not traded; originally traded in ES as +$391)

This Month (June):

• Paper account: -$117.88

[all amounts after commissions and fees, live account still pausing]

Next week I will trade a little more again. But I will not put myself under pressure. Just become part of the flow.

I know this week’s article isn’t a very insightful one but there have to be boring week’s between the one’s with great impulses, education and identification of new rules.

Have a great Sunday and week, stay healthy and green, find out if the bulls seem to be unstoppable furthermore and let me know how everything’s working for you!