This week’s weekly summary will be a short version because the focus is on new articles about coding with the IB API. But I will mention some words about the trading without fears and emotions:

The market overview

After the breakout the SPY walks upwards step by step. I expected an earlier move down for a pullback but the bulls are still buying and some VIPs aren’t using Twitter now. 😉

Although prices are rising, stochastic is around 80 and we did not have big bullish candles. Maybe the level at $310 is a first resistance and because of the straight breakout the pullback level could be at the monthly trend line through the highs and not at the breakout level at about $302.

I am still cautious watching only for the best setups until we’ll get the first higher high and higher low above the breakout level.

Trading without emotions …

Last week TCMD hit the stop loss. Why? Because I do check lots of earnings each day but didn’t recognize the earnings for the running short position. A big mistake but after trading so many years I do not feel anything. I just wrote a note in bold letters: “Close every position before earnings“. I have collected lots of those notes – with the same sentence. 😀

The biggest learning effect of it is the reminder that I must still rework my journal and statistics sheets (the conclusions when it’s done will be an interesting part of one of the next weekly summaries).

After this loss of -1R there were four new positions:

… and without fears.

One of the new stocks was COLD. Maybe the second mistake last week but from time to time I must test my intuition for such a stock at a very cheap price level. Not a good skill for a trader, I know. But I will be honest here and I will tell you about the future progress.

It had been better to wait some days after the earnings until a confirmation is formed.

After it fell another -10% I added to my long term position of YUM. Not much to say about it.

And then there are two more trades for testing small moves instead of the wide stop losses I usually use:

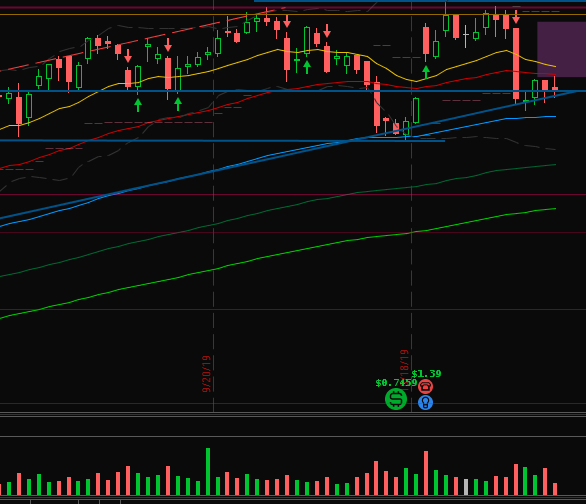

I took a very little risk but I traded the inverse head and shoulders pattern of AXP (American Express) for only a small move. It already lost of its momentum. Nevertheless, a breakout with a little gap is a good sign.

The other one was PG. Not the breakout but the move upwards in the direction of the breakout level. It triggered already but as you can see in the price action of many stocks the market isn’t as strong as some days before.

I did and do those trades in a small price area because I want to check which movements suits me better.

That’s it. I hope you enjoyed it even though the article is shorter than the last ones and the above transactions do not contain lots of knowledge. But you can see that I also do mistakes, I had overcome my emotions and I am without fears in taking good setups (in my opionion) although the market could turn down soon.

I wish you trading without emotions and fears, too. But I wish you also less mistakes than me. 😉

Subscribe to my newsletter, enjoy your life, good profits and thank you for being part of this community and blog!

16 Comments

Alessandro

(11. November 2019 - 09:31)As a young trader like myself, the thought “I’m gonna lose everything I have, if it goes on this way” came to my mind so many times… not easy to shut down that feeling….

Alexander

(11. November 2019 - 10:57)I would say that the fear of losing everything is based on a wrong risk management.

I recommend to only trade with a small part of your whole capital and from this part you should risk a maximum of 0.5% per trade in the first year. Most traders or books recommend 1-3%. That’s okay but only when you learned the basics and gained experience.

Following these rules it’s not possible at all to lose “everything” even if all your stocks will gap down, you make mistakes with the orders or whatever else can happen.

Alessandro

(11. November 2019 - 11:39)I agree with what you say, but I’m still fearfull when I read articles like this one:

https://www.marketwatch.com/story/help-my-short-position-got-crushed-and-now-i-owe-e-trade-10644556-2015-11-19

Even though I do not short stocks belonging to the Biotechonology and Pharmaceutical industries, I don’t short Stocks under $10 and I do watch the Short Ratio, Market Cap, and Earnings… still, this article is terrible and the fear is still there!

Alexander

(13. November 2019 - 14:12)You can use a good and a conservative risk management. But you won’t get profits with your trading without taking risks. Anything can happen. But like I replied to another of your comments: Trade with only a small part of your capital and risk less than 1% of that capital then your losses are very limited.

If you are fearful with every trade then I recommend to trade a longer time with your paper account. I know every trader wants to trade with real money soon. But you can be sure that you still learn a lot while doing paper trades. And you won’t have any fears no more.

Alessandro

(11. November 2019 - 12:03)And about missing earnings :

we could automatically check for earnings using the IB API, I think that should be possible, right? Or at least, save the earnings date on our local database, and instruct our application to exit before that date… Do you think that’s possible?

And by the way: where do you find the next earnings date of a given company? on finviz? on zacks? on both of them? or somewhere else? I guess I’m too lazy to look on each company’s website singularly…

Alexander

(13. November 2019 - 14:16)Of course, it’s possible to use notifications for upcoming earnings. I do already use a little program for getting informations about the earnings of stocks easily. I just have to include them in my trading codes.

There are lots of sources for earnings. The problem is that they often are different from each other. Just use the one you like most! 🙂

Alessandro

(19. November 2019 - 23:21)Given that we are trading one single strategy consistently, it could happen that for some days we do not find any quality setups at all. But it could happen that for some other days we find many of them: 2,3, 4 or even 5 high quality setups for one single day.

Given that we want to keep our portfolio to a maximum total risk of a certain percentage (for example 10%), why do some trading systems suggest not to take more than 2 positions for one single day? what is your explanation to this rule? If I find 5 high quality setups today, I could take all of them today, and I could not take any setups at all, for the upcoming weeks. Why not?

Alexander

(24. November 2019 - 11:47)Because most of the many stocks available are moving in the same direction of their market, sector and industry we always try to diversify. We chose stocks from different sectors and markets at least for long term investment.

For trading short term we limit the number of trades because we do not want our whole portfolio to move like the next 5 days. By taking only 2 trades per day we eliminate this similarity.

I often wondered that too. But since I started to only trade the best setups I can find there wasn’t one day with more than 2 perfect setups.

Alessandro

(24. November 2019 - 17:10)if we trade the 100% best setups, the number of potential trades is drastically reduced for each single strategy…. but what if we trade two strategies? in that case more than 2 high quality setups could present themselves everyday….

this week there could present 4 perfect setups everyday, and for the next three weeks none at all…. what do we do in that case? still limit to 2 per day?

Alexander

(25. November 2019 - 11:23)I did not write above that a special strategy moves in the same direction for some days. “All” stocks are moving more or less the same way. Therefore it doesn’t matter if you are using 100 strategies. The only exception you can make is when you go short and long. But on the long run shorting and going long at the same time will equalize.

But: I am not an expert! You know: Do not believe me! Try your ideas in a paper(!) account, backtest your approaches and as much as you do you will find the strategies and variations that will best fit to you.

And one advice I can give to you: First I would trade one strategy of a master, mentor or guru as long as you are profitable. And then you can start to try other approaches in your paper account parallel to it. And you can compare the closed trades and use these statistics for conclusions. It’s a long progress.

Alessandro

(24. November 2019 - 17:19)are you personally having a long term investment portfolio as well? do you entry / exit your long term investments based on technical analysis, or you stay in the stock, and use options to hedge not favorable market conditions?

Alexander

(25. November 2019 - 11:16)Yes, most of my capital is used for long term investment. But I have several accounts with different approaches. In general I can say that I love buy and hold. I backtested a lot and, yes, for shorter periods of time the moving average crossing strategies produce higher profits (sometimes!) but for long periods of 20-30 years buy & hold with companies of good quality always beat other approaches.

But I am watching the 50 SMA – 150 SMA crossing and the price – 200 SMA crossing. And at those points I am always checking the value of my stocks in detail.

No shorting or options for hedging at the moment.

Alessandro

(25. November 2019 - 13:03)your way of investing the money in the long term, is the same way as I’ve learned myself, and beginning soon to apply those principles.

But as well, I’m learning options at the moment, and I’m wondering if combining more skills together and strategies, can give us more income. I mean trading options as well, in the mainwhile…. What do you think?

Alexander

(29. November 2019 - 20:32)I know just a little bit about options at the moment. Therefore I cannot recommend anything. But there are two different views:

1. Sure, you can combine different stock strategies to get more profits – if you know what you’re doing.

2. For the beginning two many parts of trading could be confusing. And maybe you will get more profits with only one approach than combining many too early.

So, there’s no yes or no. You have to find what’s best for you. It’s a long way and I am also still on my way. I wish you huge profits!

Alessandro

(26. November 2019 - 12:52)dear Alexander,

as a beginner in the stock market, I understand only now that there are interesting stocks in the market (like AAPL for instance) that have mirrored stocks, which are buyable here in Europe.

You told me that the main reason why you would suggest to buy a mirrored stock, is because of the exchange EUR-US costs. But as a short term trader we have the same problem: isn’t it the same thing?

Given that we find an interesting stock we want to buy (like AAPL), how do we find the referring mirrored stock in the stock exchange of our home country? I currently live in Austria.

Thanks a lot, this blog is super great!!!!!

Alexander

(29. November 2019 - 21:06)Thanks for enjoying the blog! 🙂

I cannot tell you what’s “better”. You have to find for yourself. But when I buy shares to buy and hold forever I do not need high trading volume each minute. I have time, I can wait. The only reason why we use the US exchanges is the huge volumes we find there. Imagine! There are stocks traded more than several million times one day. When you want to sell at the 34th second 10:03am you will find a buyer for your transaction and you will get filled. But for the “mirrored” stocks there are sometimes hours without an order. You can see that when watching all the gaps and doji-like candles. For trading it’s a no-go. But for long term investing with the possibility of never selling the stock … why not saving commissions?