Today there are some new transactions in the Portfolio Talk below. And although the markets are not easy at the moment, I am sure you know the feeling of selling at the high.

So, let’s see what price is telling us:

Market Ideas

At 3222, the resistance from the lows before the correction, the first three days of the week built a nice rounded reversal and Thursday showed us the new direction with this long bear candle.

I marked the monthly channel with dashed blue lines for you because I mention them every week. Also, I added a channel like box above. You can see that we stayed long in this box before the bull run to 3222 started. There were many green candles but small ones. Only the break above the (blue) channel was stronger but after the reversal the profit taking began and now we’re above the box.

Will there be a …

a) … bounce on the box to the upside?

b) … break into the box after a failed breakout?

c) … just a small move up before we enter a clear next downtrend?

I tend to (b) and (c). As you know I see the channel very strong and because we’re in the middle now, we will move up or down but without a break out of the channel too soon.

The idea of a small bounce and then down is my favorite one. So, I would vote for (b) but I’ll wait with predictions before I know more about the pre-market volume and volatility tomorrow.

Portfolio Talk

Good bye, ACM!

On Monday my “hedge” position – some readers may remember my mistake that made me some hundreds of profit – stopped out. Regrettably at the top but I decided to never lose money with this last partial and to hold it without taking any additional profits.

So, I was happy about this mistake with the two really good partials and said good-bye to ACM.

Some cash for the next low

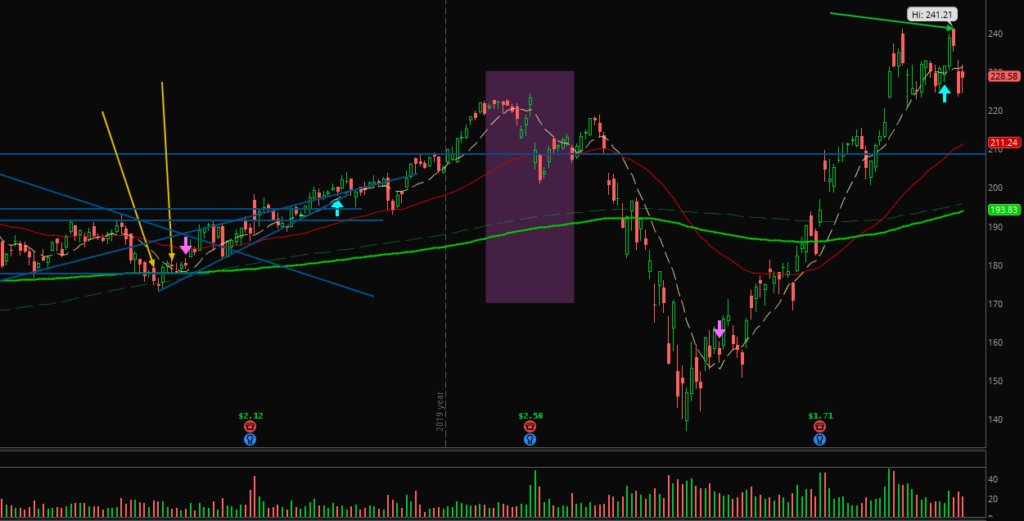

Exactly for this reason I sold 50% of my FB medium term trade. I picked a really good entry for this position, missed to add at the last low and now it was time to take some profits.

And here I had again a perfect timing: the top – but for selling, not buying back. Do you know the feeling when selling at the high? But even if the market will rally again above this high I am happy with this cash to reduce my investment rate.

Waited for the right day

I thought about selling 100% the last time. But then I sold 50% and the correction started too fast for me to react. Or I just missed it.

With UNH I also had a so nice point for the entries, the first 50% partial was a good one and now this position finished exactly before the hard sell-off: I am out, took my profits and got cash!

Even though my long term positions of the German market are not doing so well this year, my medium term trades are generating more profits than I thought of.

Futures Experiences

Now to the futures: This week was a good one. Not a big profit but I chose the best setups and the lines of my automated live-charting are really nice. My focus is more and more on setups of the higher time frames broken down to the small ones. I trade in the 5 minute chart and currently almost every trade in the MES – although I started with the MNQ for the first months.

My biggest problem is that my brain always prefers to watch out for long setups. Maybe because almost all trading examples are the bullish versions for setups. So, I used the move downwards to work on just this wrong bias. And I hope that I am a really good short trader when we’ll reach the next low. 🙂

Here’s my performance of the last week – small but positive:

Last Week:

• Paper account: +$15.57 (2 green days, 3 break even, no red days)

This Month (June):

• Paper account: -$160.87

[all amounts after commissions and fees, live account still pausing]

By the way, I am always interested in your performance, your development and your ideas!

Maybe you can add your experiences in a guest article? Or just tell me about your trades in the comments?

And now after the market overview, my position changes of ACM, FB and UNH and the lines about futures I want to thank you for reading my articles and following my blog idea!

Thank you and that you know the feeling of selling at the high!